On May 3, 2024, German right-wing populist politician Maximilian Krah, who was the AfD’s lead candidate for the 2024 European elections, claimed on Tiktok that the European Central Bank was destroying people’s savings and that, although it was promised that the euro would be as stable as the German Mark, it was as stable as the Turkish lira. This claim turns out to be mostly false.

In connection with the European elections and the demands for national currencies mentioned in the AfD’s election manifesto, AfD politician Maximilian Krah points to three aspects that need to be examined. The first is that the European Central Bank is destroying people’s savings, the second is that the euro should be as stable as the German Mark and the third is that the euro is as stable as the Turkish lira.

The role of the European Central Bank and its influence on savings

The European Central Bank has the task of ensuring price stability in the eurozone. Since 2014, the European Central Bank has been applying low or negative interest rates to stimulate the economy and control inflation. The ECB specifies the interest rate to be charged by the respective central banks of the European countries, which they pass on to the banks. The deposit interest rate is constantly adjusted by the ECB, and since 2014 it can also be below 0%, i.e. negative; banks can pass on negative interest rates to their customers, which means that a negative interest rate reduces the return on savings. This makes saving less attractive and investing in a loan more attractive. A table from the European Central Bank shows that the interest rate has not been negative for three and a half years. This means that AfD politician Krah’s statement that the European Central Bank is destroying people’s savings could be factually correct but does not apply to the last few years due to the positive interest rate.

The promise of the German mark and the stability of the lira

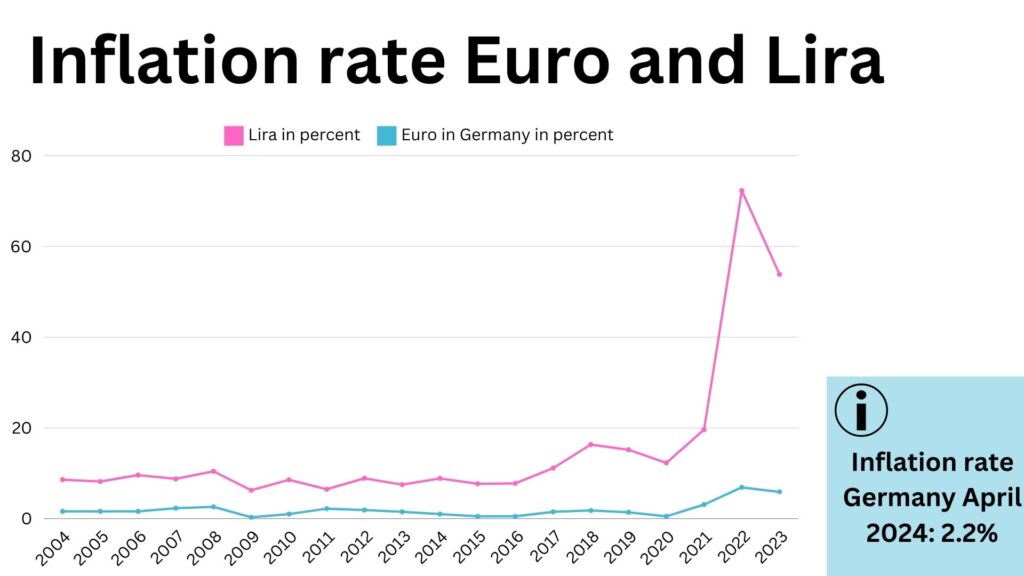

“The euro will be as strong as the German Mark.” This statement was made by Helmut Kohl, the then Chancellor of German reunification in 1990. The ECB pursues a policy of price stability with an inflation target of less than 2%. Historically, the D-Mark has maintained a low inflation rate, which was a measure of stability. If you calculate the average inflation rate of the last 10 years (2013-2023), you arrive at a rounded overall figure of 2.5%. If, we calculate the inflation rate of the last 10 years of the German mark (1988-1998), we arrive at a rounded figure of 2.8%. According to the inflation rate of the last 10 years, the euro is therefore even slightly more stable than the German Mark.

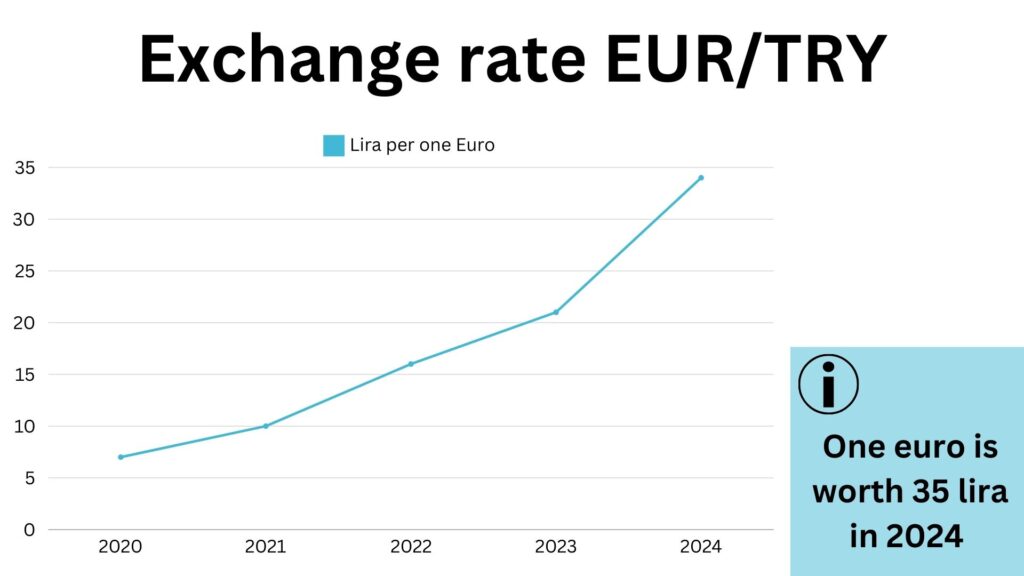

The Turkish lira, on the other hand, which according to Maximilian Krah is just as stable as the euro, had an inflation rate of 59.52% in 2024. The inflation rate in Germany is currently 2.2 percent.

The significantly lower inflation rate in Germany compared to the Turkish lira shows the stability of the euro against the Turkish lira. The exchange rate of the euro to the lira also shows that the euro is stronger than the lira.

Conclusion

The statement by AfD politician Maximilian Krah that the European Central Bank is destroying our savings and that, as promised, the euro should be as stable as the German Mark was as stable as the Turkish lira is mostly false. This is because savings are being reduced by the European Central Bank, but the interest rate has not been negative in recent years. Based on the inflation rate over the last 10 years, you can see that the euro has a slightly lower interest rate compared to the German Mark, which indicates that the euro has lower inflation over 10 years than the German Mark, which speaks for stability. The statement that the euro is as stable as the lira is false and can be refuted by several indicators.

RESEARCH | ARTICLE | Amelie Eckstein, Hochschule der Medien Stuttgart, Germany

Leave your comments, thoughts and suggestions in the box below. Take note: your response is moderated.