Referring to the European Central Bank (ECB) the german „Frankfurter Allgemeine Zeitung“ (FAZ) headlined on September 24th, 2020: “In the crisis, people are hoarding cash.“ Even if the term “hoarding” is incorrect in this case, all other figures, facts, quotations and the context are correct, which is why the claim is to be assessed as “mostly true.”

The claim refers to the fact that the rising money supply also increases the fear of inflation among some people. The term “money supply” includes cash, money in current accounts and money-similar securities and investments. The money supply is once again divided into three sub-levels. The money supply M3 is the broadest available money supply and includes all available money including debts and securities. The medium money supply M2 is smaller and contains only deposits with a maturity of up to two years (term deposits) and deposits with an agreed notice period of up to three months (savings deposits). The narrowest amount of money is the amount of money M1, which only includes cash and savings with immediate access, for example in current accounts.

Higher money supply and cash circulation

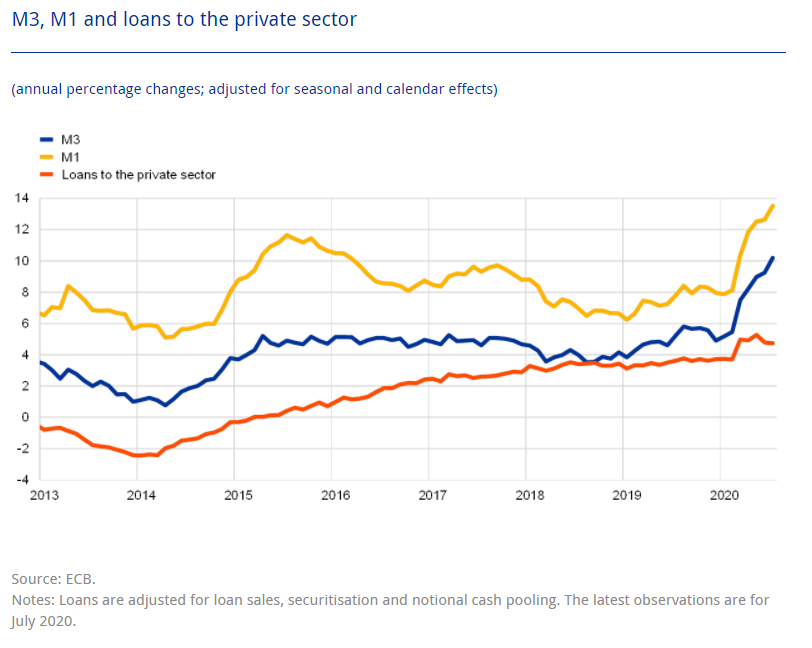

In his article the author writes – which the ECB confirms in their Economic Report of September, 24th 2020 – that the M3 increased by 9.2 percent in June 2020 and by 10.2 percent in July, and that the main reason is a sharp increase in cash and sight deposits in current accounts. In addition, according to the ECB, cash in circulation increased in July at a monthly rate of 9.8 percent. Moreover, the annual growth rate of the most liquid monetary aggregate, M1, which comprises overnight deposits and currency in circulation, rose to 13.5 percent in July, after 12.6 percent in June, and thus strongly contributed to M3 growth.

The chart below shows the increase of the money supply M1 and M3 in the middle of 2020. The reasons for the increase are numerous. In this context, the economic journalist correctly quotes that the increase in money supply on current accounts is mainly due to the deposits of companies.

We contacted Dietmar Köster. Since 2014, he has been Managing Director of the

manufacturer Oerlikon Friction Systems and an expert in the field of finance and economics. “In crises, it is normal for companies to collect money in their accounts in order to remain liquid in case of doubt”, says the economist. With regard to the increase in cash, he also confirms: “This is also normal. People save cash, either because of insecurity or involuntarily due to a lack of spending opportunities. As a result, the ECB and the expert can confirm that both, money supply and cash circulation, have increased.

As an example of the high saving ratio during the crisis, FAZ cites the figures for Germany from the German Central Bank (DZB). The information provided by Stefan Bielmeier, Head of Research and Chief Economist of DZ BANK AG Deutsche Zentral-Genossenschaftsbank, is consistent with the figures in the FAZ report. For example, the savings ratio in Germany in the second quarter was around 20.1 percent and therefore significantly higher than in the previous year.

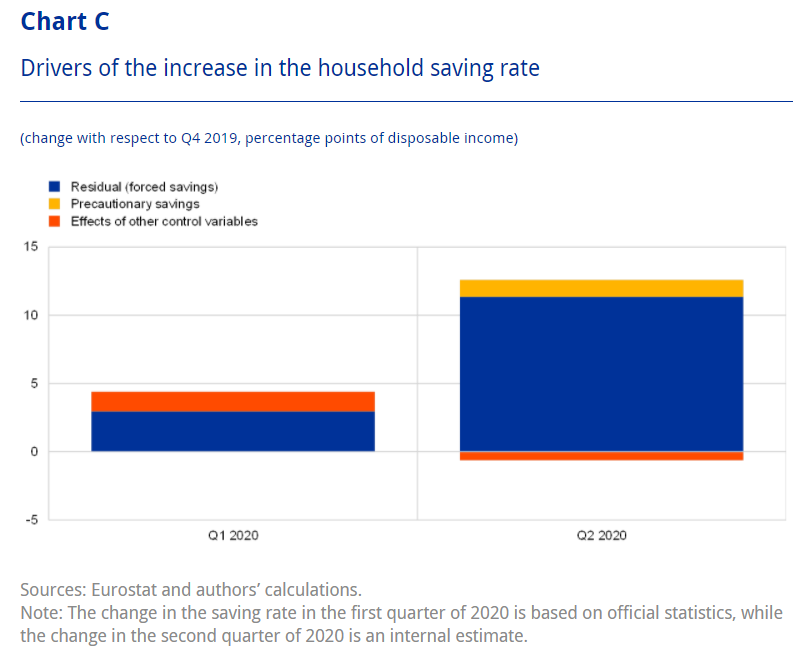

In addition, the DZB expects a saving ratio of 16 percent for the whole year, after 10. 9 percent in the previous year. All other figures in the text also match those in the reports of the DZB. The ECB also confirms the increased saving ratio for the European area. Therefore, the savings ratio in the first quarter of 2020 was historically high at just over 17 percent.

With regard to the claim, these figures show that people are saving money during the crisis. However, the term “hoarding” is problematic.

Involuntary savings because of Covid-19

First of all, we have to look at the reasons for saving money, which the auther also looks at in the last third of his text. Again, he refers to the calculations of the ECB’s experts. According to the ECB report, the increased savings ratio was on the one hand due to the most recent rise in expected unemployment, and because of that precautionary savings made a significant contribution to the higher savings ratio in the second quarter, on the other hand, the involuntary savings of private households due to the lack of opportunities for spending, for example through travel bans or the partial closure of recreational facilities and restaurants. Here, the article correctly quotes the ECB’s report, which states: “Unintentional saving seems to be the most important factor in the recent increase in household savings. In the model shown below, the proportionality between precautionary savings and the remaining size, the involuntary savings, can be clearly seen.

Since the main reason for saving happens involuntary, the term “hoarding” in the claim has to be discussed critically. According to the dictionary, the definition for the german translation of hoarding, „horten“, is: “Collecting something because of its scarcity/preciousness”. This definition refers to the conscious action of people who, for example, collect items. Nathalie Schneider, a graduate of the masters program in German Studies at the University of Würzburg and currently teacher of German and geography at the Realschule Kitzingen, confirms this on request: “It is a synonym for gathering at a time of scarcity and therefore should definitely be defined as a knowing action.”

In this case, however, people do not save knowingly, but mostly involuntarily, as the newspaper states in the article. The author has nevertheless decided to use the term hoarding in the claim, although this is not correct in this context. This may lead to misunderstandings of the claim.

Conclusion

In summary, the FAZ-claim “In the crisis, people are hoarding cash” generally matches the facts. People are saving, respectively collecting more cash, which can be proven with the correctly quoted figures of the ECB’s economic report. The only problem is the misleading word “hoarding”, which claims, the people would save up their money by choice. In reality people save money involuntarily. Considering that the core of the statement as well as the facts in the accompanying report are correct in all areas, the claim can be assessed as “mostly true”.

RESEARCH | ARTICLE © Matthias Kwoll, Jade Hochschule, University of Applied Sciences, Wilhelmshaven, Germany

Also read the related blog post: Keynes’ Theory of Employment, Interest, and Money proves itself during corona crisis.

Leave your comments, thoughts and suggestions in the box below. Take note: your response is moderated.