On 25 March 2019, Antti Rinne, the Chairman of the Social Democratic Party of Finland, claimed in his electoral interview that based on the experiences in Sweden, the Finnish Ministry of Finance has estimated that getting online payment terminals would prevent the grey economy from occurring by 140 million euros per year in Finland. The claim is mostly true because it complies with its source. However, Rinne forgets to mention the other end of the value range.

Every time we do not get a receipt from a purchase, we could be supporting grey economy. The new online buffered cash register system could be the answer, according to the Finnish Ministry of Finance.

On 25 March 2019, Antti Rinne, the Chairman of the Social Democratic Party of Finland, claimed in his electoral tv interview:

“Based on the experiences in Sweden, the Finnish Ministry of Finance has estimated that getting online payment terminals would prevent the grey economy from occurring by 140 million euros per year.”

Antti Rinne bases his claim on a report by the Finnish Tax Administration. It was commissioned by the Ministry of Finance to research what kind of fiscal register system would work best in Finland.

The grey economy, also known as the shadow economy, refers to all work activity and business transactions for which taxes are not payed. The phenomenon is a problem especially in cash based industries, such as construction and restaurant business.

A task force of the Finnish Tax Administration proposes the implementation of online fiscal cash register systems in Finland. According to their report, concealing income is a means of shadow economy and results in a lack of tax revenue. At its simplest, it means not registering the purchasing transaction in the cash register system or the accounting.

How the suggested system works

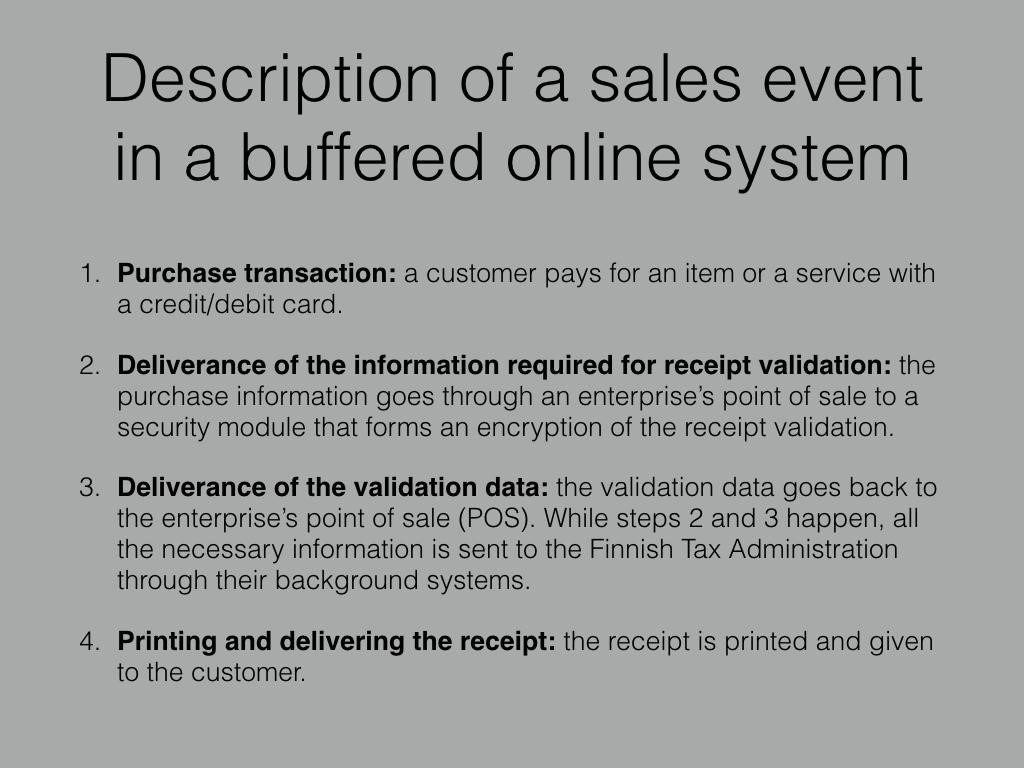

An online payment terminal is the little machine in which we put our credit card when we buy things. The payment terminals are usually connected to a larger hardware, the cash register system. Now the Finnish Ministry of Finance suggests that connecting the payment terminals to the Internet would allow a more automatic taxation in Finland – hence the term “fiscal”.

The fiscal cash register system saves the data in an internal memory, or the buffer. Then the information is sent automatically to the Finnish Tax Administration. The main idea of the buffered online system is to enable purchasing transactions even if the data connection to the Tax Administration has been lost.

The truth with a twist

Firstly, we did find the correct numbers in the source so we could say that the claim by Antti Rinne is true. However, Rinne only talked about 140 million euros even if the report mentioned a scale of 120–140 million euros.

Secondly, Rinne stated that the estimate came from the Finnish Ministry of Finance. Technically, this is not true because the report was executed by the Finnish Tax Administration. The Ministry of Finance commissioned it. Ultimately, even though the statement was technically correct, Antti Rinne did not take into account the costs of implementing such systems that were also presented in the report.

Janne Marttinen, the Head of Grey Economy Information Unit of the Finnish Tax Administration, confirms that the number that Rinne has presented does comply with the estimations that the Tax Administration has made based on the experiences among Finnish and Swedish companies.

Also costs involved

Even if Rinne did not comment the net impact of the planned reform on the public economy, we wanted to find out whether it would bring considerable costs.

According to the report by the Finnish Tax Administration, it would cost 24 million euros to the Tax Administration to establish the system. The annual growth of tax revenue can be expected to increase by 120–140 million euros a year. For comparison, Finland gets 157,5 million euros as EU income support and market support every year.

The reform would apply to between 40 000 and 170 000 companies depending on the scale. To companies this would require upgrades in cash register systems or new acquisitions of hardware.

Marttinen says that most of the expenses are nonrecurring costs and would not have been avoidable anyway. The digitalisation of the financial management of companies, where information is in structural form, would bring massive gains for companies. According to Marttinen, yearly operating costs would not change much for the companies. Acquisition costs are tax-deductible.

After Finnish Parliamentary election 14 April 2019, the country is waiting for a new government to be formed. It remains uncertain how the new government will respond to the suggestion on the cash register system reform. The law is in the preparation phase. Antti Rinne is the person who will lead the effort to form a new government.

We found the correct numbers that Antti Rinne used in his statement from an official source and they are backed by Janne Marttinen, the Head of the Gray Economy Information Unit of the Finnish Tax Administration. However, Rinne did not mention that the estimate proposed in the report was not a simple figure but a scale, nor did he take into account the cost of the implementation of the new system. Despite the imprecise citation of the source, we think this claim is mostly true.

Leave your comments, thoughts and suggestions in the box below. Take note: your response is moderated.