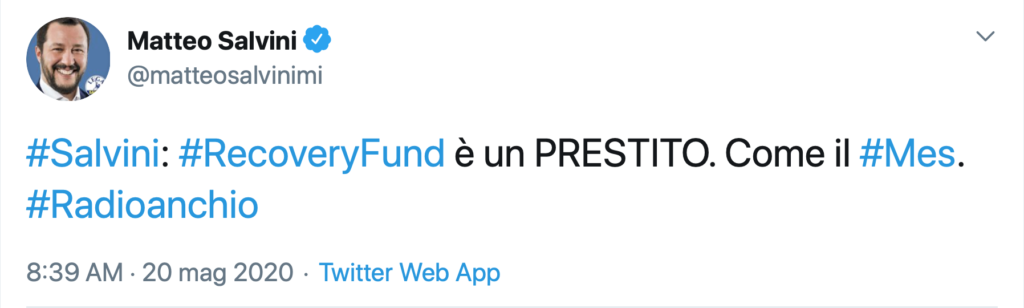

On the 20th of May, Matteo Salvini, leader of the Italian Far Right party “The league”, rejected the proposal for a post-Covid EU grant-based recovery plan, outlined by the French President Emmanuel Macron and the German Chancellor Angela Merkel and unveiled in a surprising press conference on the 18th of May. A statement issued on air in the show “Radio Anch’io” Radio and reposted on Twitter said in full:

#Salvini: #RecoveryFund is a LOAN. Like the #Esm. #Radioanchio

A resounding rejection, yet announced the night before, when Salvini – speaking on the TV talk show “Stasera Italia” on Rete 4 – had declared:

We have been told for weeks: “How can you say no to ESM? It is interest-free, it has no conditions”. Then one goes to check, these weeks, Greece said no, France said no, Spain said no, Portugal said no. Either they are all fools if it is a gift, or, evidently, it is not a gift. Neither the ESM, nor this fund which is a loan. I do not condemn the idea, but it is not money given away, it is money lent. At this moment there is no lira, or euro that is a freebie: they are loans. One can say whether the loan is convenient for them or not. In my opinion, Italians are looking for another type of loan. Today the treasury bonds destined for Italian savers were snapped up: five billion today, three billion yesterday, and as many tomorrow and the day after tomorrow. So, in my opinion, the Italians have understood that these years’ Europe is little to be trusted.

Matteo Salvini’s statement is mostly false, as it simplifies a more complex perspective. The Recovery Fund project provides for the allocation of resources to be partially drawn from the European Community budget. Italy is the third-largest contributor, after France and Germany, with a rate of 14% of the overall budget of the European Union, thus paying more than it receives. The appropriations foreseen by the Recovery Fund would be established based on the economic losses due to the pandemic, and not based on the share of national wealth – as for the regular contribution – and paid to the Member States through net transfers (directly, as in the case of the structural funds). Such a weighting would allow the hardest-hit states to receive more than they contribute to, without burdening the public debt. In concrete terms, for Italy the net balance would be positive. According to current estimates, it would receive € 55 billion, the result of the difference between the € 125 billion envisaged by the plan for the first year and the € 70 billion in regular contributions.

On the other hand, the funding provided by the Recovery Fund, should come from:

- The issue of common debt securities on the financial markets. The interest rates would be between 0.1% and 0.5%. An AAA-rated supranational entity would issue the bonds. In addition to the States, the ECB would probably buy the debt securities, and the expiration of the aid would last for ten years;

- The introduction of European taxation, with which the European institutions could, therefore, collect taxes directly within their borders (such as a digital tax or a carbon tax).

Only if the European taxation project weren’t finalized, the EU states would be asked to repay the financing through an extraordinary contribution, whose size is yet to be defined.

As for conditionalities, the Franco-German document explains that the recovery plan would be supported by commitments from EU governments to undertake “sound economic policies” and healthy structural reforms. The plan would become operational from 1st January 2021 as part of the Multiannual Financial Framework 2021-2027. Economy Commissioner Paolo Gentiloni has urged EU leaders toward an agreement, and everything should be ready by mid-September 2020, but more will depend on which plan will be chosen and when it will be approved: on 27 May the EU Commission proposed a recovery package, a different solution compared to Merkel and Macron’s project.

Conclusion

According to the Franco-German proposal commented by Salvini, Italy will certainly have to take part in financing the European budget and the Recovery Fund integrated into it. Still, it is a pretext to call it a loan. To date, it remains undefined whether, when and how the European taxation project will take place. The expected revenues could guarantee the European Union the resources hoped for, and allow the Member States to get out of the economic crisis. Therefor we conclude that Salvini’s claim is mostly false.

RESEARCH | ARTICLE © Catholic University, Milan, Italy

Leave your comments, thoughts and suggestions in the box below. Take note: your response is moderated.