In the German “Welt” live TV debate on 11th April 2024 between the right-wing Björn Höcke of the AfD and the moderately right-wing Mario Voigt of the CDU, Björn Höcke said: “It is wrong that Brexit has damaged the UK.” He went on to say that “Germany is in recession” and “the British economy is at least stable and the prospects are much better than for the euro area – these are the current figures”. While Höcke was right about Germany being in recession, if you look at the economic impact of the UK’s exit from the EU (Brexit) so far and the current figures on the UK’s economic prospects, a different picture emerges. His claims turn out to be mostly false.

Björn Höcke from the AFD (left) vs Mario Voigt from the CDU (right) in the “Welt” TV debate

The TV debate was a platform for the European and Thuringian state election campaigns. In the EU election program of the AfD (Alternative for Germany) the party considers the European Union a failure, so Höcke has an incentive to put the EU in a bad light. Also, it is important to note that when Höcke talks about “Great Britain” and the “British” economy, he actually means the United Kingdom. This distinction is relevant because it is the United Kingdom, not Great Britain, that has left the EU.

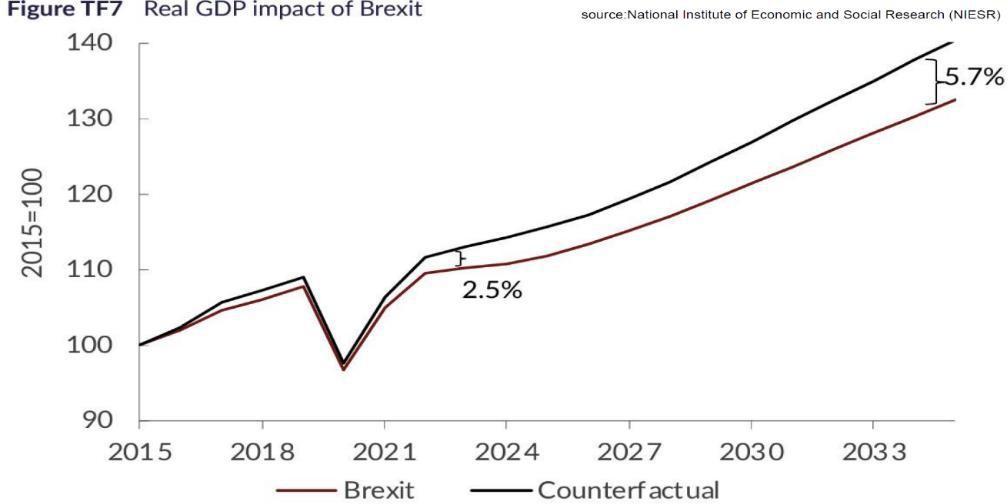

While it’s difficult to pinpoint economic change in the UK since 2016 (when the Brexit referendum happened) due to the COVID-19 pandemic and the Russian invasion of Ukraine, the London-based National Institute of Economic and Social Research (NIESR) concludes in its 2023 report that Brexit did hurt the UK.

The impact of Brexit on the UK till now

The National Institute started its observations with the EU-UK Trade and Cooperation Agreement in 2021. They point out that the UK now has a decline in trade with the EU which also led to reduced inner-country trades, a reduction in production, as well as a permanent reduction in investments in the UK. It says these circumstances lead to a 2-3 % lower GDP (Gross Domestic Product, i.e. how much money a country has made of all finished goods and services in a period) than what the GDP would have been, if the UK had stayed in the EU. In other words, the model suggests that a UK citizen now has £850 less to spend per year due to Brexit – and that is with taking both the pandemic and the war against Ukraine into account.

However, it is important to put these findings into context. While the National Institute’s conclusions are significant, other studies and viewpoints should also be considered. For example, Brexit supporters may argue that the UK’s ability to set its own trade policy could lead to long-term economic benefits. For example, Patrick Minford’s study “Trading on the Future: Brexit Trade Options & the UK Economy” looks at the potential economic benefits of different Brexit trade scenarios. Minford says that if the UK leaves the EU, it could boost consumer spending and the economy. He estimates that this would lead to a 4% increase in GDP and an 8% fall in consumer prices. Even if other countries don’t drop their barriers, the UK would still be better off economically. They could also point to the UK’s vaccine rollout during the COVID-19 pandemic as an example of the benefits of greater autonomy outside the EU. The UK started its vaccination campaign in December 2020, ahead of the EU. This could be seen as an advantage of greater autonomy.

Germany in recession?

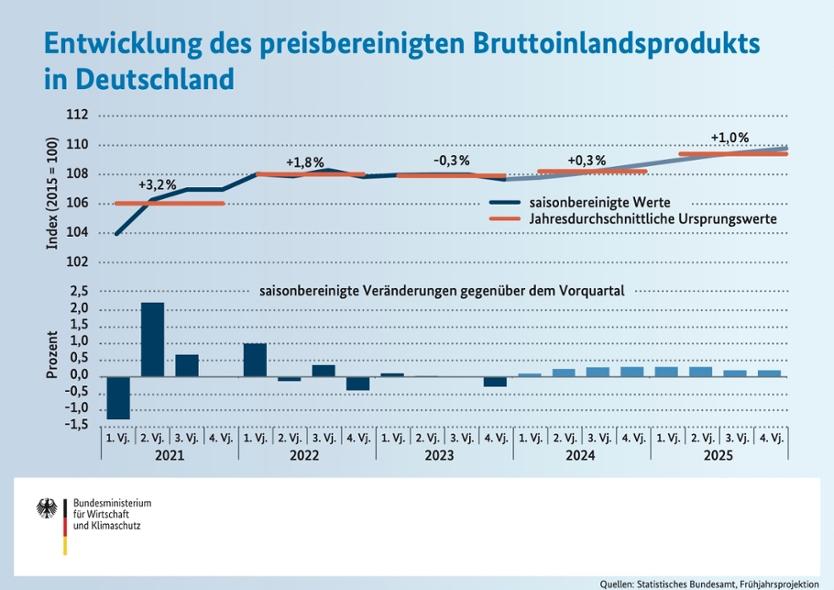

In some countries, including the UK and Germany, the convention is that two quarters of negative GDP growth indicate a recession. Höcke said at the beginning of April 2024 that “Germany is in recession”. This is actually true, as Germany was in recession in 2023 due to a lower GDP compared to the year before. This holds true until March 2024, the month before the TV debate, thus Höcke is right on this one. But his statement only holds up for the first quarter of 2024 as the prognosis for Germany’s GDP is positive again for the whole year of 2024 and the upcoming years. According to the Federal Ministry for Economic Affairs and Climate Action (BMWK), the GDP growth forecast for 2024 is +0.3% and +1.0% for 2025.

UK versus euro area: Who will win the economic race?

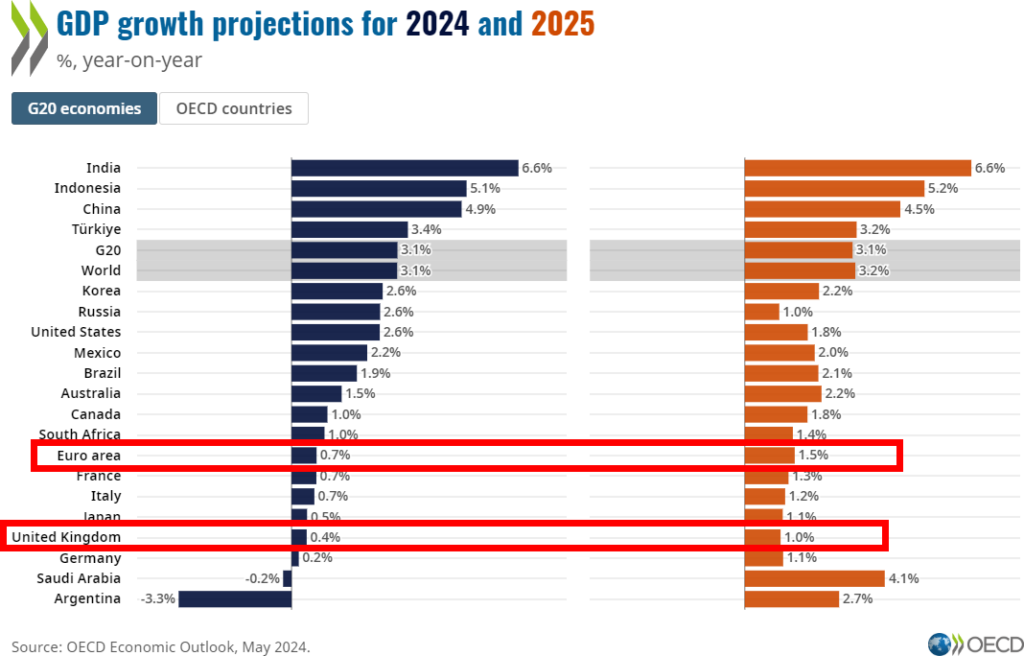

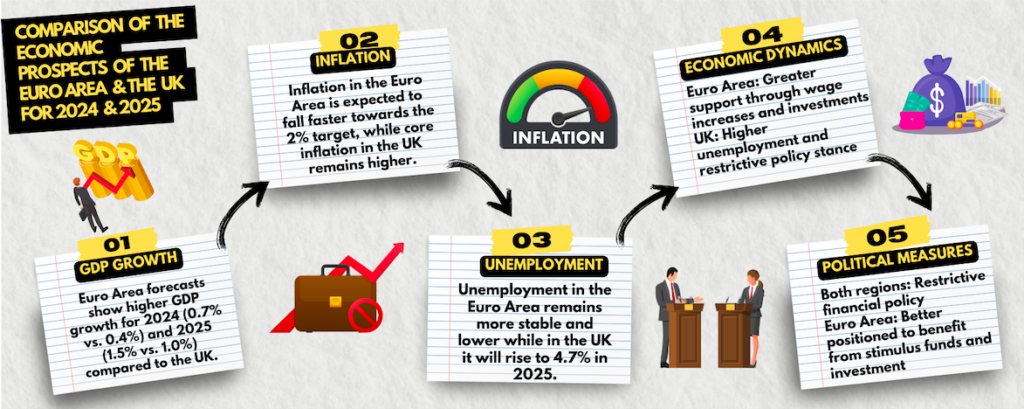

The euro area consists of the 20 countries that have the euro as currency. Höcke said that “the outlooks of the British (UK) economy are way better than that of the euro area- those are the latest numbers” but our research paints a different picture. According to the OECD (Organisation for Economic Co-operation and Development) the prospect of UK’s GDP growth is 0.4% for 2024 and 1.0% for 2025. On the other side the OECD predicts for the ruro area a GDP growth rate of 0.7% for 2024 and 1.5% for 2025, suggesting that the euro area has a better economic prospect, the opposite of Höcke’s statement.

Source: OECD Economic Outlook, May 2024

The American investment bank “Goldman Sachs” suggests the UK’s GDP will grow slightly next year with an overall increase of 0.6% for the entire year of 2024. This is slightly higher than the OECD’s forecast of about 0.4% growth for the whole year. On the other hand, the OECD still expects the euro area to outperform the UK with GDP growth of 0.7% in 2024 and 1.5% in 2025.

Why is the UK expected to be outperformed economically by the euro area?

Goldman Sachs research suggests that the UK won’t do as well as the US and the euro area by 2024. Why? Well, Goldman Sachs suggests higher inflation, more fragile mortgages, more long- term sickness and higher structural unemployment all play a role. There are also challenges to the UK’s financial stability, with the high cost of inflation-protected bonds and rising foreign debt making it harder for the government to support the economy through spending and tax policy. The UK’s economic outlook isn’t as rosy as Björn Höcke makes it out to be, especially when compared to the euro area and the US. Inflation is likely to fall faster in the EU, while it will remain higher in the UK. The EU also has lower and more stable unemployment rates and better wage support and investment programmes. Meanwhile, unemployment in the UK could rise to 4.7% by the end of 2024.

Conclusion

While Björn Höcke remains right about Germany being in recession (in that time period) our analysis shows that the Brexit did in fact hurt the economy of the UK and the outlooks are better for the euro area than they are for the UK. His statements “It is wrong that Brexit has damaged the UK” and “the British economy is at least stable and the outlook is much better than for the euro area- these are the current figures” are proven wrong – the opposite is the case.

RESEARCH | ARTICLE | Deborah Herberg, Luca Assmuss, Hochschule der Medien (Stuttgart, Germany)

Leave your comments, thoughts and suggestions in the box below. Take note: your response is moderated.